Index underscores affordability as the defining force in today’s auto market, blending J.D. Power Dependability data with real-world pricing to rank 27 brands

New York, September 3, 2025 — Affordability is the defining factor in today’s auto market, and the Dave Cantin Group’s new Vehicle Quality & Pricing Index (QPI) shows which brands are best positioned to deliver it. The first-of-its-kind ranking combines J.D. Power Dependability Study data with average retail transaction prices, revealing that Buick, Mazda and Toyota are setting the standard for value among mainstream brands, while Lexus leads the luxury segment.

Introducing the Quality & Pricing Index (QPI)Methodology: Why we built this index

The goal of the Dave Cantin Group’s new Quality and Pricing Index is to take available industry data, then combine and analyze it for a glimpse of which automotive manufacturers are best positioned in today’s macroeconomic environment.

The QPI evaluates and compares brands using two key factors:

- Reliability, an indicator of the brand’s vehicle quality, measured by using J.D. Power’s U.S. Vehicle Dependability Study — specifically, the problems-per-100-vehicles metric.

- Price, measuring a brand’s relative affordability, using Cox Automotive/Kelley Blue Book’s annual average transaction price for each brand.

By combining these factors into a single index, the QPI presents a holistic view of each brand’s performance. To ensure that all metrics are comparable, the Dave Cantin Group analysts first normalize each factor to a common scale, rated from 0 to 100. The best-performing brand in each category — meaning the most reliable and the least expensive — receives a score of 100, with all other brands scaled proportionally.

Higher QPI scores represent the brands with the combined best reported reliability and lowest average prices. The Dave Cantin Group divides nameplates into luxury and mainstream brands for the best marketplace relevance.

THE AUTO BRANDS IN THE DRIVER’S SEAT TODAY

Who’s in the lead when affordability and reliability are more important than ever?

Buick and Mazda top a new analysis of automotive brands’ current value propositions.

These two very different brands, followed closely by Toyota, have done the best job offering consumers affordable and reliable vehicles in a year of economic uncertainty. That’s the verdict of the inaugural Vehicle Quality and Pricing Index (QPI) from the Dave Cantin Group (DCG), one of the industry’s leading M&A advisory companies.

DCG’s QPI cross-references reliability data with retail pricing numbers to rank 27 top auto brands. While Buick, Mazda and Toyota have hit the value sweet spot among the QPI’s 16 mainstream brands, Lexus and Cadillac are the leaders among 11 luxury nameplates.

“At DCG, we are constantly looking for ways to analyze data and develop insights that will help our clients — dealership principals and executives — make better business decisions about their strategic growth, including investing or divesting of assets,” said DCG President Brian Gordon. “Reliability and affordability have long been two of the most critical factors impacting consumer purchase decisions, and in light of the current macroeconomic uncertainty, we believed future market share gains could be correlated to manufacturers that were delivering consumers both of these.”

Turns out that premise — at least in 2025 — is correct.

ANALYZING THE TOP BRANDS

While Buick topped the 2025 QPI with a 7% drop in average transaction price and the fewest reported problems per 100 (PP100) vehicles, the GM nameplate also posted one of the industry’s top market share gains in the first half of 2025. Buick’s share of sales was 1.43%, up from 1.14% the previous year — a 25% gain.

For Brian Traugott, the DCG partner and chief of staff who led the project, it all makes sense. The 2025 QPI is based on numbers that shoppers are likely to reference while researching a new vehicle — so a well-priced brand with a strong reliability record would top a lot of consumers’ search results. “In the first half of the year, we have seen Buick, Mazda, Toyota and Kia gaining share — and those are the brands at the top of our QPI,” he said. “Based on our QPI data, Subaru rounds out the top five for mainstream brands. The brand might also be increasing share, but the company is always limited by product availability.”

2025 DAVE CANTIN GROUP QUALITY & PRICING INDEX: MAINSTREAM BRANDS

Buick, Mazda and mainstream brands lead rankings

| MAINSTREAM BRAND | DEC. 2024 INDEX SCORE | DEC. 2023 INDEX SCORE | YEAR-OVER-YEAR INDEX CHANGE |

|---|---|---|---|

| 1 Buick | 97.72 | 93.57 | +4.14 ↑ |

| 2 Mazda | 90.92 | 86.71 | +4.22 ↑ |

| 3 Toyota | 81.42 | 90.74 | -9.32 ↓ |

| 4 Kia | 75.87 | 85.61 | -9.74 ↓ |

| 5 Subaru | 74.73 | 83.46 | -8.73 ↓ |

| 6 Nissan | 74.65 | 84.05 | -9.40 ↓ |

| 7 Honda | 74.21 | 79.29 | -5.08 ↓ |

| 8 Mini | 74.19 | 83.67 | -9.48 ↓ |

| 9 Chevrolet | 67.88 | 68.74 | -0.86 ↓ |

| 10 Hyundai | 66.67 | 79.14 | -12.47 ↓ |

| 11 Volkswagen | 46.25 | 56.41 | -10.16 ↓ |

| 12 Ford | 42.84 | 38.56 | +4.28 ↑ |

| 13 GMC | 36.62 | 31.90 | +4.72 ↑ |

| 14 Chrysler | 30.57 | 26.28 | +4.28 ↑ |

| 15 Jeep | 28.07 | 55.97 | -27.90 ↓ |

| 16 Ram | 23.69 | 39.87 | -16.18 ↓ |

Source: Dave Cantin Group analysis of J.D. Power 2024 & 2025 U.S. Vehicle Dependability Study and Cox Automotive/Kelley Blue Book 2024 Report

2025 DAVE CANTIN GROUP QUALITY & PRICING INDEX: LUXURY BRANDS

Lexus tops list; Cadillac, Lincoln post biggest gains

| LUXURY BRAND | DEC. 2024 INDEX SCORE | DEC. 2023 INDEX SCORE | YEAR-OVER-YEAR INDEX CHANGE |

|---|---|---|---|

| 1 Lexus | 95.52 | 93.21 | +2.31 ↑ |

| 2 Cadillac | 68.27 | 61.27 | +7.00 ↑ |

| 3 BMW | 65.70 | 61.56 | +4.15 ↑ |

| 4 Genesis | 65.44 | 66.16 | -0.72 ↓ |

| 5 Infiniti | 64.95 | 61.30 | +3.65 ↑ |

| 6 Lincoln | 59.30 | 44.65 | +14.64 ↑ |

| 7 Acura | 59.02 | 71.07 | -12.05 ↓ |

| 8 Audi | 43.55 | 38.50 | +5.05 ↑ |

| 9 Mercedes-Benz | 42.04 | 48.69 | -6.65 ↓ |

| 10 Porsche | 32.71 | 35.71 | -3.01 ↓ |

| 12 Land Rover | 11.48 | 6.15 | +5.33 ↑ |

Source: Dave Cantin Group analysis of J.D. Power 2024 & 2025 U.S. Vehicle Dependability Study and Cox Automotive/Kelley Blue Book 2024 Report

Toyota’s strong showing in the QPI is not a surprise to Randy Hoffman, chief operating officer for Ed Morse Automotive Group and its 58 dealerships. “We can never get enough Toyotas. If you sent me 100 more Toyotas, I’d sell them all. The demand is always there,” said Hoffman, complimenting the brand’s value reputation and its financing operation.

Traugott agreed. “Toyota is a brand that has been a mainstay for consumers because of these exact factors measured by the QPI — affordability and reliability — and that’s why dealers love the brand as well,” he said. “On the other hand, the rankings of Buick and Mazda validate recent moves by each OEM and the corresponding growing interest by consumers and dealers — something we have been keeping an eye on.”

Said Michael Brown, owner-operator of Long Island, N.Y.-based Empire Automotive Group and its 20 dealerships: “Buick is a brand that people thought might go away. But today they are a really solid brand building very nice cars.”

DCG noted that Buick is scoring in the marketplace with its smaller and less-expensive models, including the Envista, Envision and Encore GX. “Buick has created a niche on the entry level of its product lineup where the vehicles are attractive and equipped well, while also being priced right — importantly doing so while they also have done a good job keeping the brand dependable,” Traugott said. “We believe Buick’s strategic buyouts have helped improve throughput, and thus mindshare, of its remaining dealer body. All this has contributed to their share gain as well.”

“Toyota is a brand that has been a mainstay for consumers because of these exact factors measured by the QPI — affordability and reliability — and that’s why dealers love the brand as well.” — Brian Traugott, Dave Cantin Group

Brown, who became a Mazda dealer in 2023, is also not surprised at the brand’s top QPI ranking. “Mazda has seen a lot of growth over the past 18 months. A couple of years ago, they were barely in the conversation. Now they have a very nice product lineup, and they’re grabbing market share,” he said. “They make very progressive vehicles for the younger generation and are getting a lot more looks than they used to.”

MORE WINNERS, LOSERS — AND SURPRISES

For the most part, the market’s key mainstream brands — including not only Toyota but also Subaru, Honda and Kia — also performed well in the inaugural QPI. However, brands like Ford, Chevrolet and GMC, where trucks are a key part of the portfolio, ranked lower. “Today’s premium truck prices are a drag on affordability,” said Traugott. In 2024, DCG first noted cost conscious buyers’ shift away from full-sized trucks and large SUVs back toward smaller and more affordable vehicles and called that out in its Market Outlook Report (MOR). That trend has continued in 2025, he said, as consumers feel less confident about the U.S. economy. “Many people are saying, ‘If this compact SUV or sedan does what I want it to do, maybe I don’t need to go up in price to that full-size truck,’” Traugott said.

The 2025 QPI offers other surprises, including Nissan’s placement alongside Honda and Subaru near the top of the index. Traugott’s perspective: “In a world where Americans are seeking affordable, reliable vehicles, for all the problems at Nissan corporate right now, it doesn’t appear to affect the products. Perhaps the affordability of its current lineup is also partly due to an aging product line that offers slightly lower prices.” Nissan had the lowest average transaction price among mainstream brands.

On the flip side, one of the immediately apparent indicators is the position of Stellantis’ Chrysler, Dodge, Jeep and Ram brands at the bottom of the QPI ranking. “It’s unsurprising but validating to our research,” Traugott said. “Part of the reason people have complained about these brands, Jeep in particular, is that the company went outside its price sweet spot. In addition, there’s that commonly heard slogan among dealers: The Jeep Wrangler is a Teflon brand, but it’s always in the shop.”

Reliability and Affordability Drive Car-Buying Decisions

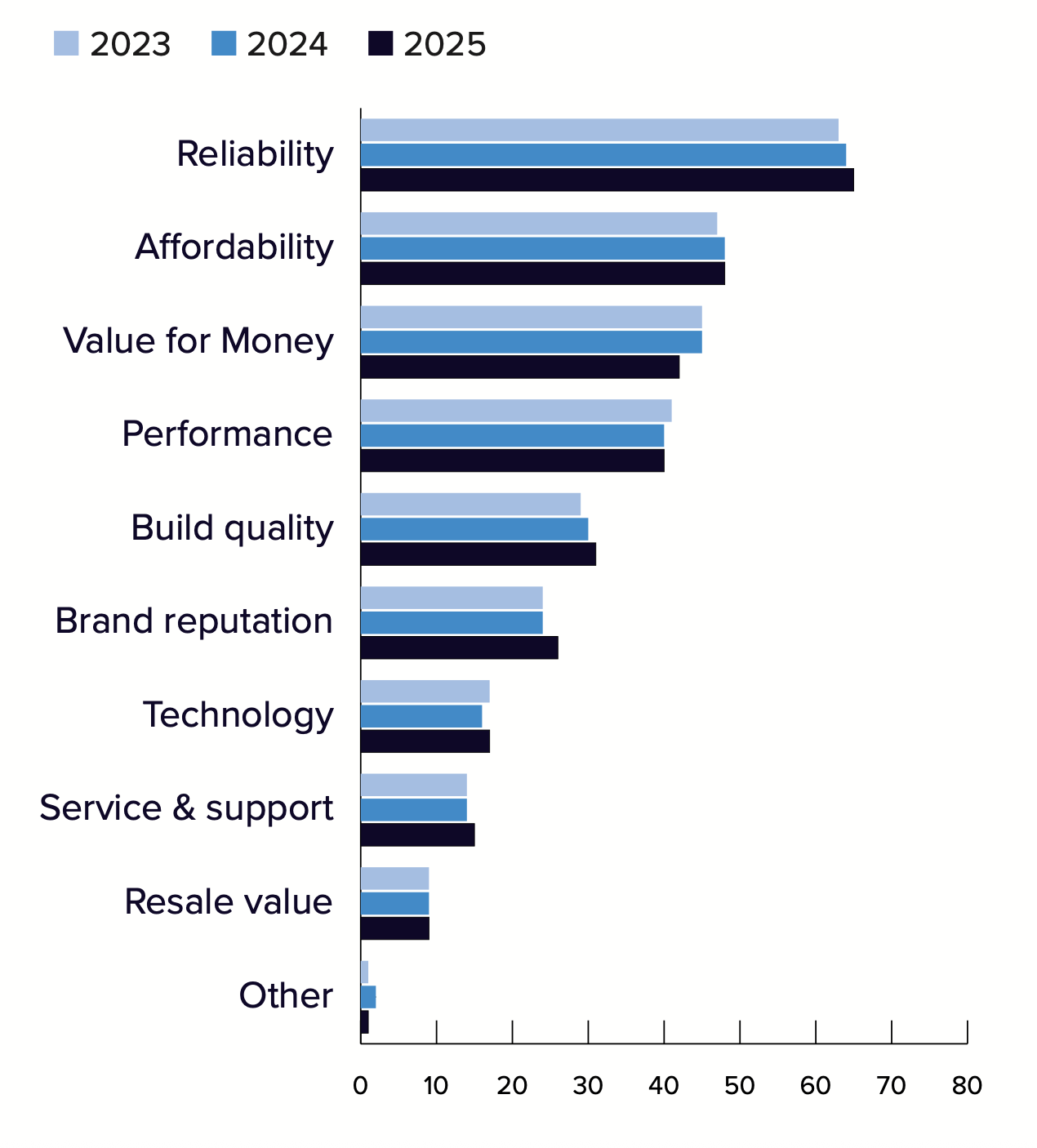

According to the Kaiser Associates 2025 Midyear Dealership Survey, published in the Dave Cantin Group Market Outlook Report (MOR), reliability stands as the top deciding factor for car buyers, with nearly two-thirds placing it among their top three criteria. Affordability follows closely behind, cited by almost half of consumers, highlighting how trust in a vehicle and the cost of ownership remain the twin anchors of purchase decisions.

When selecting a car brand, which are the 3 most important criteria for you? (Percent of respondents selecting in top 3.)

On the flip side, the position of Stellantis’ brands at the bottom of the QPI rankings is “unsurprising but validating to our research.” “So, when you consider everything the brand has experienced in terms of reliability and desirability, negative news, pricing issues and losing share, it’s not surprising that we find CDJR at the bottom of this list.”Hoffman defends CJDR’s product quality. “I don’t see the quality being an issue. It’s the pricing that is of concern. That has been a failed attempt at changing their customer base,” he said. “They abandoned their core customer. And the hardest business to get is the business you lost.”

LEXUS LEADS LUXURY NAMEPLATES

When looking at the top brands in the luxury-focused QPI ranking, Traugott said Lexus makes sense as the brand leader. “The story you get with Toyota you also see with Lexus — the brand balances luxury, affordability and reliability.” Rounding out the top three on the luxury side are Cadillac and BMW. While both are on the higher end of the average-price spectrum, they also both are in the top four of the PP100 for luxury brands. Traugott believes this confirms that even consumers who are less price-sensitive are focused on dependability and cost over the life of ownership. Hoffman, a GM megadealer, said he’s been impressed by Cadillac’s strategy. “Cadillac has really excelled over the past few years. They found a way to lower the average age of their buyers — they did a good job figuring out how to convince customers that it’s not your father’s Cadillac anymore,” he said. Traugott also theorizes that popular luxury nameplates like Porsche and Mercedes-Benz appear toward the bottom of the QPI list partly because of their higher price tags but also because their technology-forward models may result in more interactions with dealership service departments. “The luxury brands see higher PP100 numbers in general, and at least part of it is buyer care and expectations that lead them back to the dealership more often,” he said.

IMPLICATIONS FOR 2025 — AND BEYOND

The auto industry loves data, and it’s exciting to have a new way of looking at brands. But what does the QPI analysis ultimately mean, not just for car buyers but for dealers? Market observers say consumers’ focus on value and affordability is not going away and will continue to shape auto sales and financing decisions, especially in the near term. Brown’s dealerships compete in the lease-heavy New York market. “When people come in, they point to a car and ask, ‘What’s my payment?’ And right now, our customers are very payment-conscious,” he said. “They are asking where they are going to get the best value.” Traugott points out that in addition to persistently high interest rates, sticky inflation, a potentially slowing job market and the end of federal student loan programs means more financial pressure on young consumers. “For a variety of reasons, we believe that the average consumer will feel more and more pinched for the foreseeable future and will continue to look for affordable options in a vehicle. In this environment, reliability is a proxy for saving time and money,” he said. “Because of that, we think we will continue to see an increase in the desirability of the brands at the top of our QPI list — both in terms of more eyeballs and consideration, and ultimately more sales growth.” He continued, “From a consumer standpoint, it’s clear: If a top consideration in your mind is a vehicle that is reliable in an affordable price range, maybe you should check out Buick or Mazda.” Market observers say consumers’ focus on value and affordability is not going to go away. For dealers, the QPI analysis can provide insights about current and future investments. “If you are a dealer or dealership group, you want to think about investing with an OEM with a vehicle lineup or product road map that is positioned to succeed, to grow sales and gain market share,” Traugott said. “If you are in acquisition mode, it’s important to know which manufacturers have gotten this right.

are an owner with multiple franchises of a manufacturer that doesn’t have the lineup or road map to compete, it should give you pause.”

“In the first half of the year, we have seen Buick, Mazda, Toyota and Kia gaining share — and those are the brands at the top of our QPI.” Brian Traugott, Dave Cantin Group

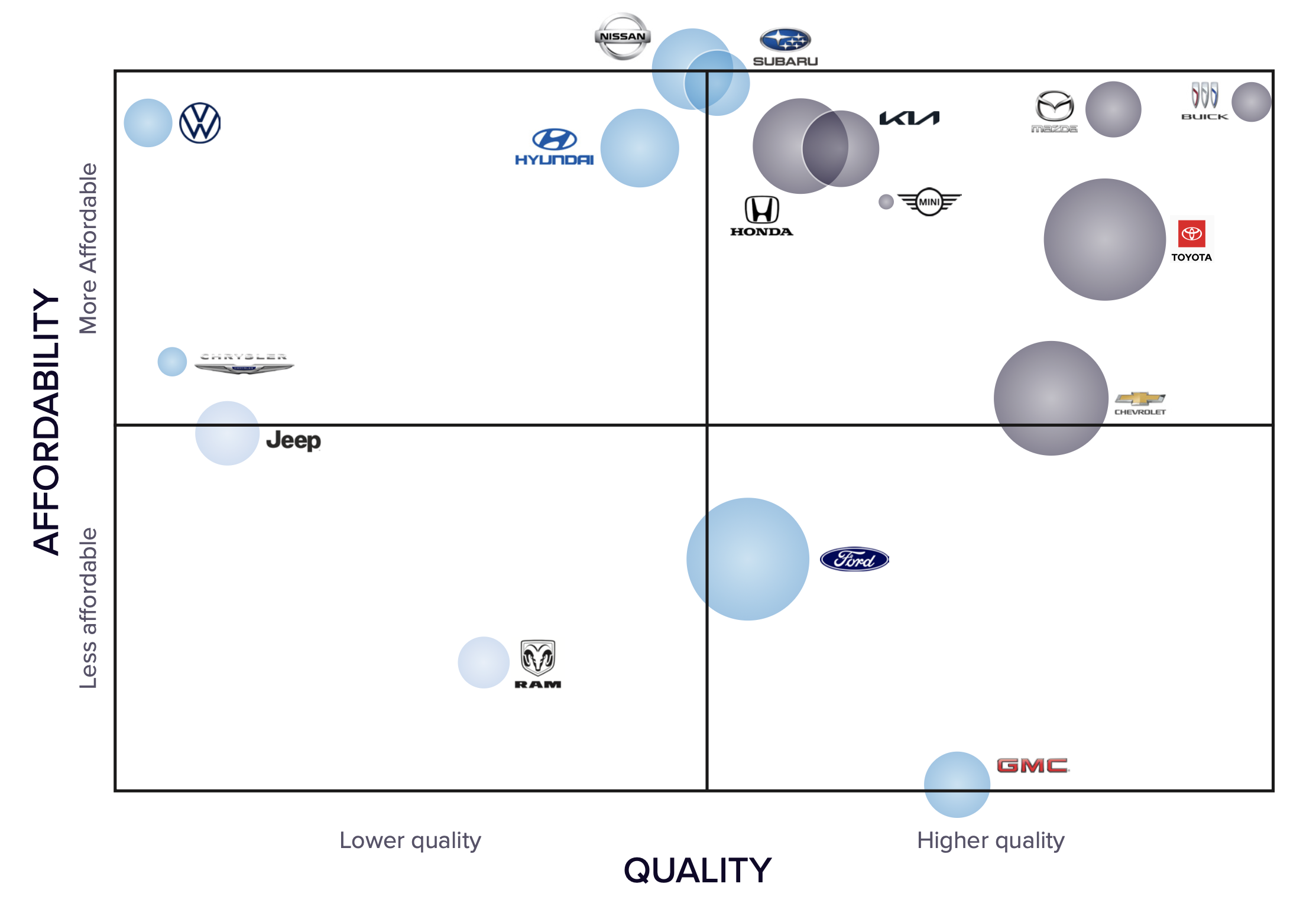

AFFORDABILITY AND RELIABILITY, MAPPED MAINSTREAM BRANDS:

Where quality meets affordability — at the top

Source: Dave Cantin Group analysis of J.D. Power 2025 U.S. Vehicle Dependability Study and Cox Automotive/Kelley Blue Book 2024 average transaction prices. Bubble size represents 2024 U.S. sales (units).

These charts plot each brand by its relative affordability and quality based on the Quality and Pricing Index (QPI), with bubble size representing U.S. sales volume. Brands in the upperright quadrant combine higher quality with stronger affordability — positioning them well to capture market share.

Brands in the lower quadrants face challenges either on price, on reliability, or both.

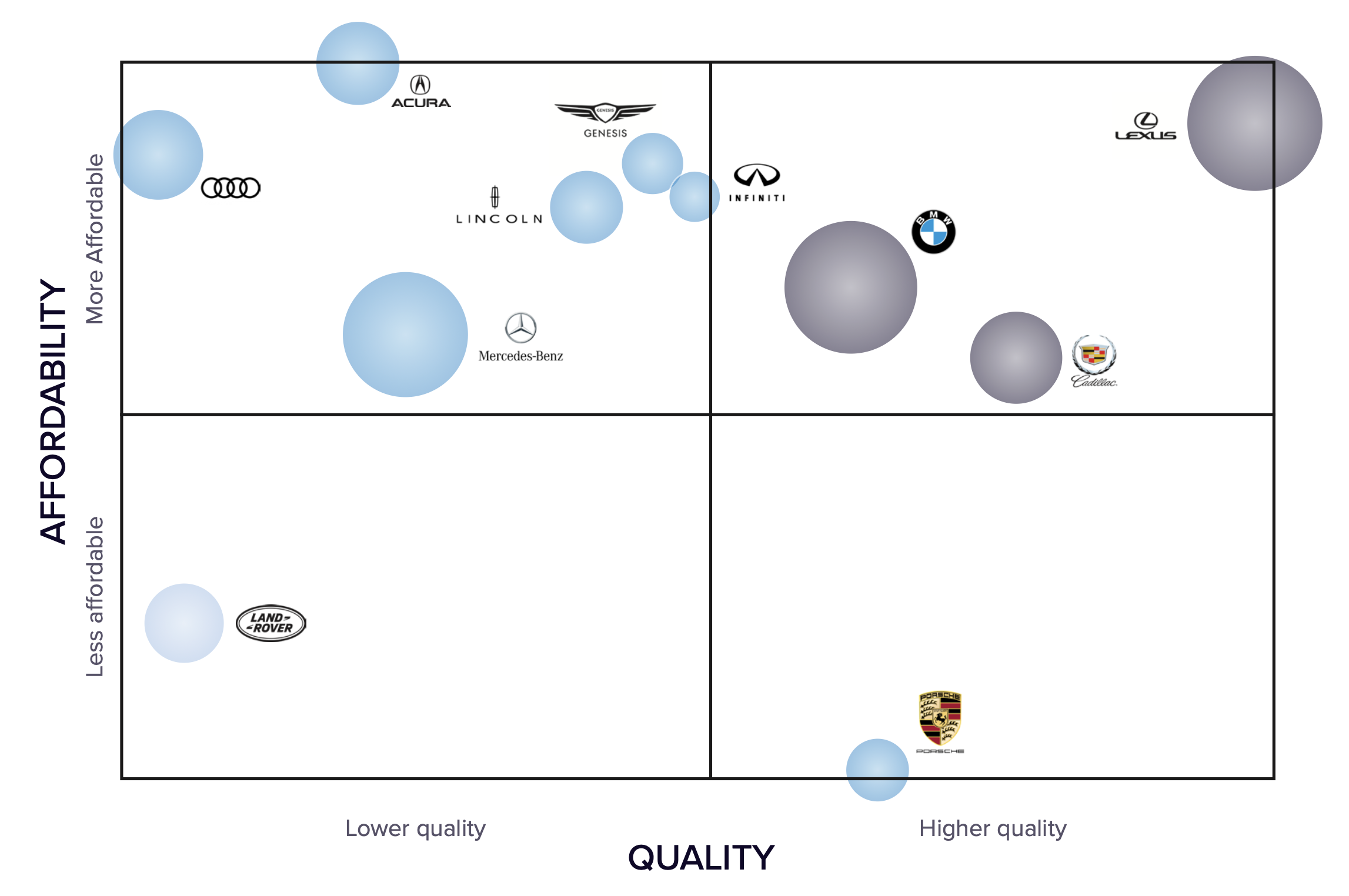

AFFORDABILITY AND RELIABILITY, MAPPED LUXURY BRANDS:

Where quality meets affordability — at the top

Source: Dave Cantin Group analysis of J.D. Power 2025 U.S. Vehicle Dependability Study and Cox Automotive/Kelley Blue Book 2024 average transaction prices. Bubble size represents 2024 U.S. sales (units).

ABOUT DAVE CANTIN GROUP

The Dave Cantin Group is an The Dave Cantin Group is a leading automotive mergers and acquisitions (M&A) advisory company specializing in acquisitions, divestitures, and market intelligence.

As the M&A services provider of choice for North America’s top dealership groups, DCG advises on about 40 transactions annually. Our team is defined by a strategic, long-term approach to client relationships and a commitment to proprietary data tools that drive smarter decisions. Through our M&A intelligence division, we deliver timely insights in the Market Outlook Report (MOR), produce industry-leading content and power our advisory services with Jump IQ, our award-winning AI platform.

Appendix

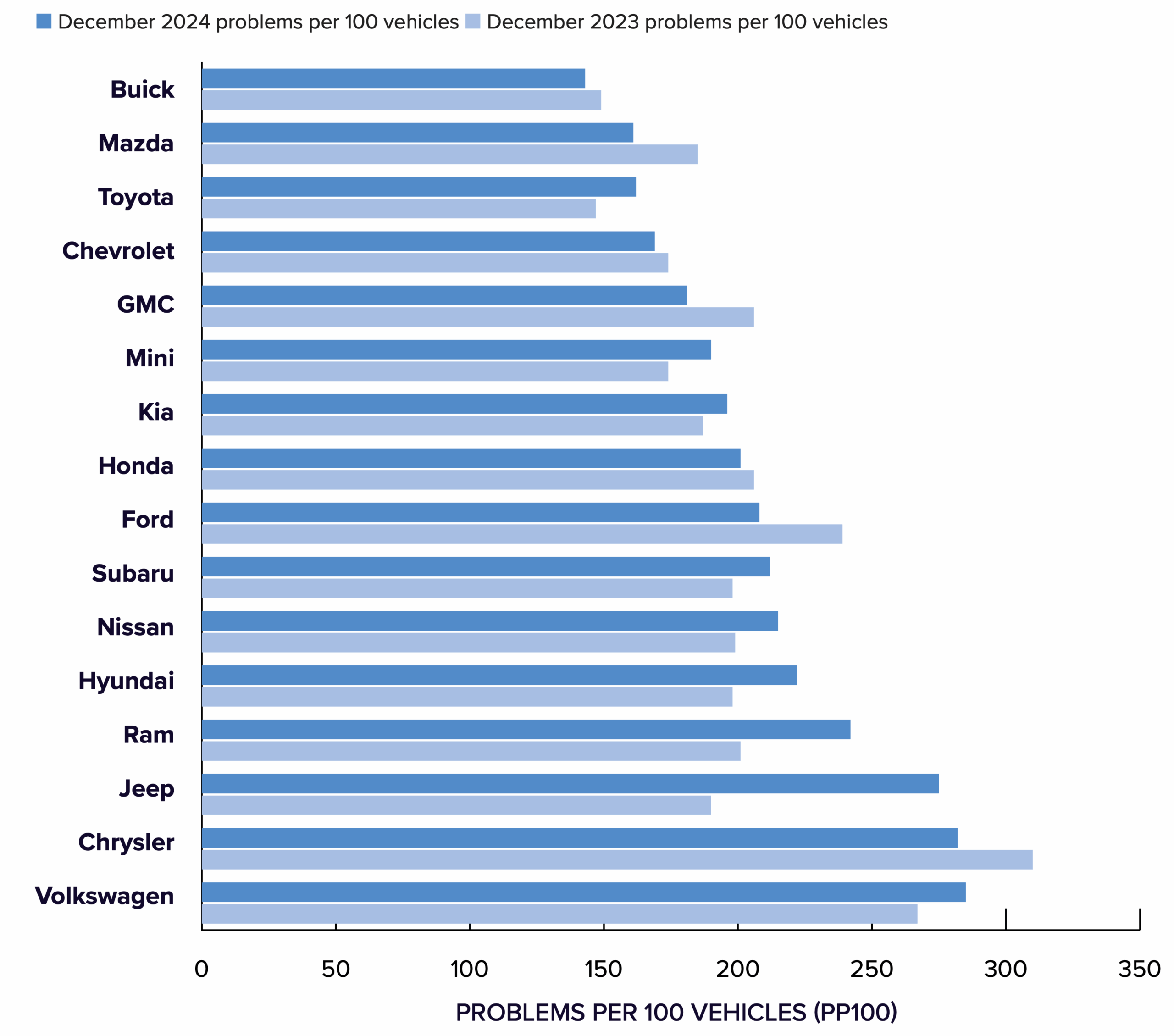

JD POWER VEHICLE DEPENDABILITY MAINSTREAM BRANDS:

Reliability Rules

No surprise that the top 3 in the QPI for mainstream brands and the top 3 in reliability are one and the same.

Source: J.D. Power 2024 & 2025 U.S. Vehicle Dependability Study. Scores represent reported problems per 100 vehicles (PP100;lower scores indicate higher reliability)

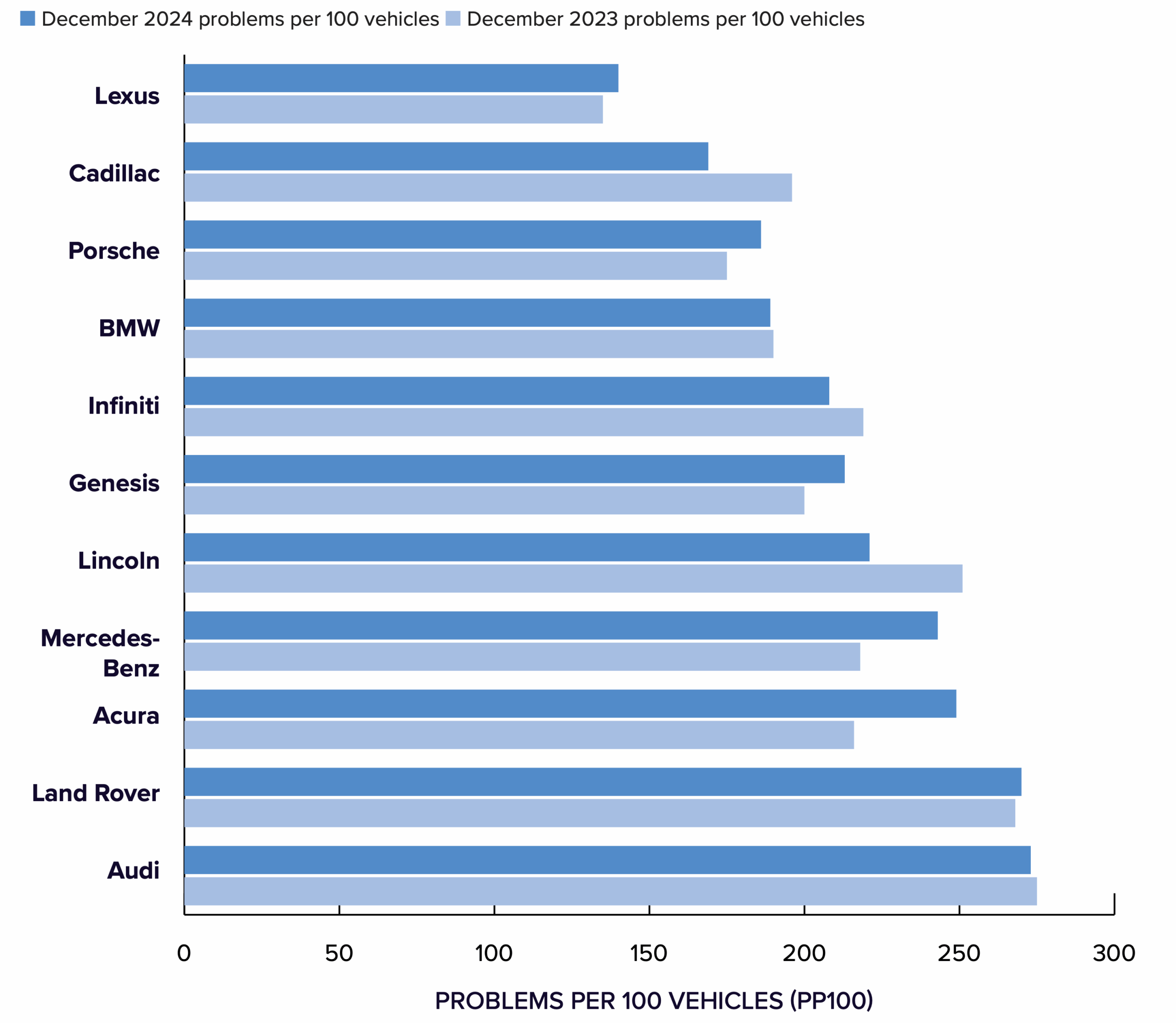

JD POWER VEHICLE DEPENDABILITY LUXURY BRANDS:

No Luxurious Lemons, Please

Consumers with money to spend aren’t willing to cut corners on quality.

Source: J.D. Power 2024 & 2025 U.S. Vehicle Dependability Study. Scores represent reported problems per 100 vehicles (PP100;lower scores indicate higher reliability)

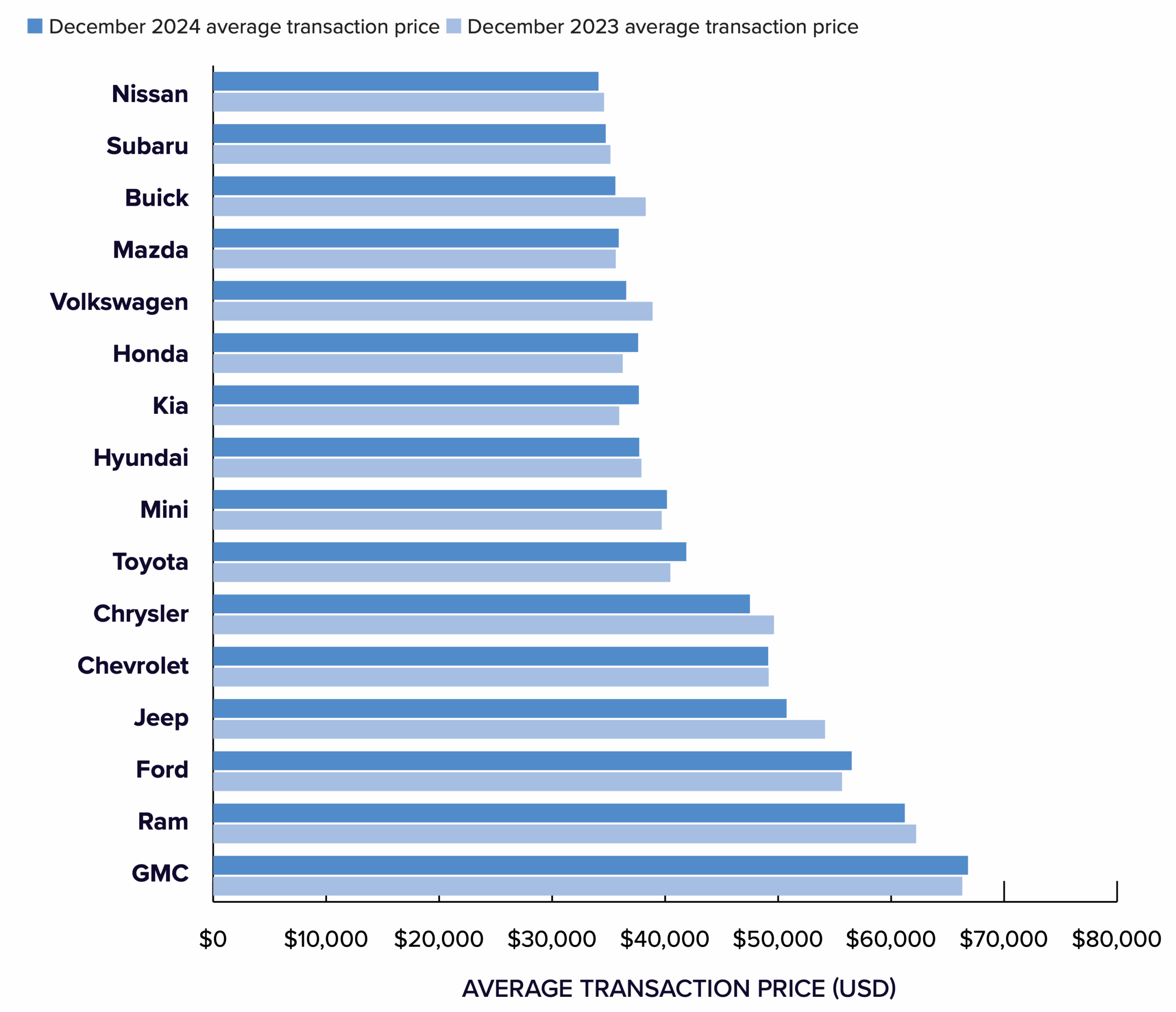

KBB PRICING MAINSTREAM BRANDS:

Price — But Value, Too

The top 3 in the QPI mainstream segment may not be the top 3 in average transaction price, but their demonstrated dependability makes them a good deal in the eyes of consumers.

Source: Cox Automotive/Kelley Blue Book 2024 Report. Values represent average transaction prices by brand, December 2024 vs. December 2023.

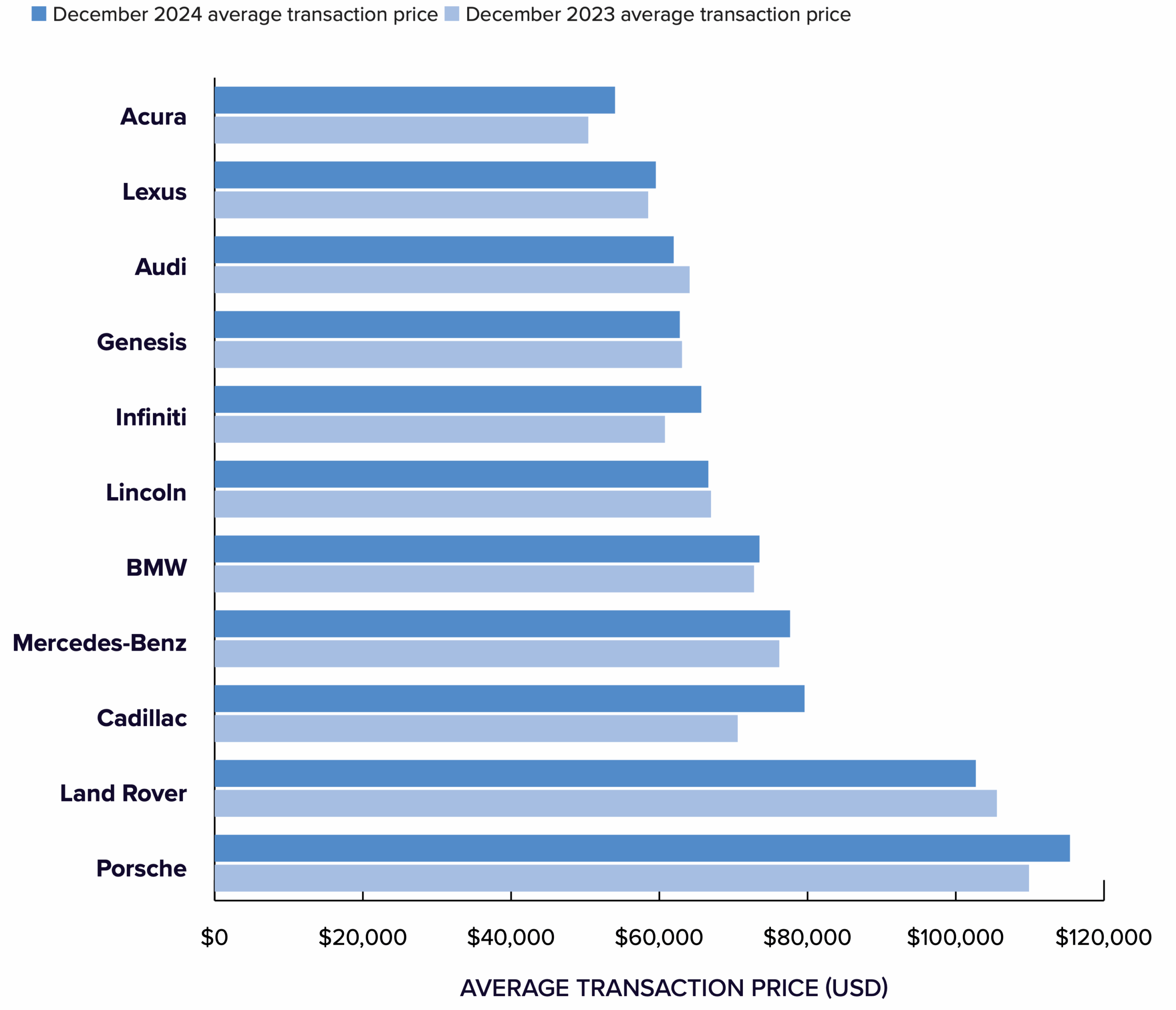

KBB PRICING LUXURY BRANDS:

Money is No Object (Sort of)

Luxury shoppers are less likely to feel sticker shock but still want dependability with some affordability.

Source: Cox Automotive/Kelley Blue Book 2024 Report. Values represent average transaction prices by brand, December 2024 vs. December 2023.

Read more coverage on CBT News, Auto Remarketing, Consumer Affairs, Automotive News, and The Pinnacle Gazette.